What will happen to property prices in Spain in 2023?

Will property prices in Spain rise or fall in 2023, now that they are expected to fall in most of Europe? What are the factors that make the Spanish housing market slightly different from its European neighbours?

European Central Bank

The European Central Bank (ECB) has warned that house prices across Europe will fall by as much as 9 per cent over the next two years.

As inflation affected economies across the continent, the ECB radically raised interest rates and Euribor, the rate for mortgages in Spain, has since risen sharply. This will have an impact on housing demand and prices in Spain in 2023, but it will not be nearly as severe as in other European countries.

Property prices in Spain have been rising for some time, but will they fall in 2023? And how is the Spanish market different from the rest of Europe?

The market

Experts predict that 2022 will see an end to the sharp increases the Spanish property market has seen in recent years, in which both sales and prices rose at a pace not seen since before the housing boom in 2007.

According to Atlas Real Estate Analytics, about 168,000 purchases and 166,000 sales were recorded in the third and fourth quarters of 2022, with an annual total of 665,754 property transactions, 2 per cent more than the 650,913 in 2021.

By 2023, however, the strong market growth is expected to start slowing down, with the number of sales expected to fall to 563,450 – a future slightly above the three years just before the pandemic. In this sense, in terms of property purchases and sales, 2023 should bring a normalisation of the market, with the shape of the market returning after several years of extremes. However, price and sales declines will not be as sharp as in the rest of Europe.

Want to read more about real estate and the Costa del Sol? Check out these articles:

- BREXIT or NO BREXIT

- UPCOMING: 04/10 INVESTINSPAIN INFODAY

- Career switch in Corona crisis

- Successful info day at Silo’s

- Buying property in Spain without pitfalls

Prices

What does this mean for prices?

Although the total number of real estate transactions (purchases and sales) is expected to fall by about 15 per cent in 2023, the decline in house prices will be only 0.9 per cent, according to Atlas Real Estate. 2022 will end with an average price of €1,706/m², 2.9 per cent higher than in 2021. In 2023, however, the average price per square metre is expected to fall slightly to €1,691 – a drop of almost 1 per cent.

According to data from Spain’s National Institute of Statistics, INE, house prices are increasing by 8 per cent year-on-year. Experts believe this rate of increase will continue until the end of 2022, largely due to inflation, but that property prices will slow in 2023 as the market stabilises.

Supply on the Spanish property market

This is partly due to the fact that supply in the Spanish property market cannot keep pace with demand, so the larger price drops predicted across Europe are unlikely to be seen in Spain. In major cities like Madrid and Barcelona, supply has fallen by around 39%, although overall demand in 2023 is expected to be lower than in 2021 and 2022.

Over the past year, Spanish property prices have risen due to the combination of high demand and low supply, along with a decrease in the construction of new homes due to the increased price of materials. This price spike is expected to slow down, but any price drops are expected to be marginal.

UPDATE March 2023

The housing market in Spain is facing quite a challenge. According to an analysis by ING Spain, house prices will fall by seven per cent in the coming years. The sharp rise in interest rates and tighter credit values are the main causes of the market cooling. However, a crash like the one that followed the financial crisis in 2008 and 2009 does not seem to be on the cards.

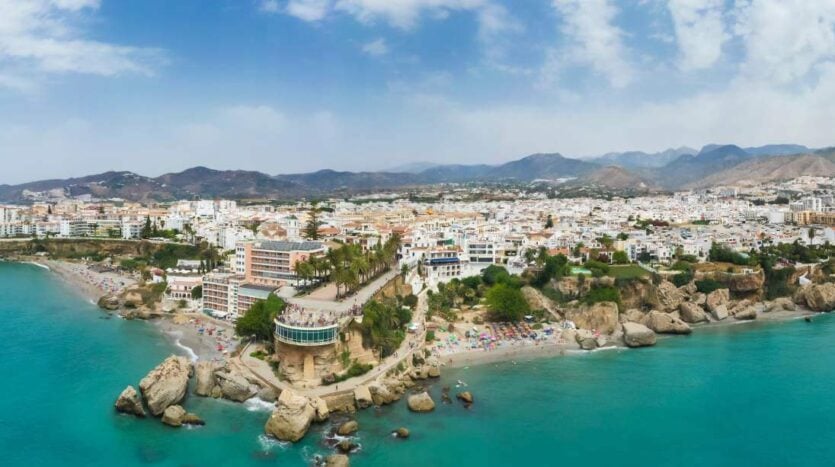

Costa del Sol cheaper

The Spanish property market is still doing better than the eurozone average, but prices are expected to stagnate rather than rise rapidly after 2024. This is mainly because interest rates are going up. According to the bank’s analysts, the downward trend will be visible in all regions, but especially on the Mediterranean coast, the Balearic Islands and the Canary Islands. Nevertheless, prices are still expected to rise in urban areas, partly due to limited land availability and strong growth in housing demand.

Trust

However, confidence in the Spanish property market remains high, as evidenced by continued high demand for mortgages. Yet the question arises as to how long this will last. Indeed, as a result of ECB interest rate hikes, mortgage rates will also go up, making loans more expensive. This could ultimately negatively affect the demand for mortgages and hence the demand for houses.

Other interesting blogs like property prices in Spain:

New construction versus ‘second-hand’

However, this does not mean that prices of certain types of housing will not fall.

Property experts also predict that there will be price differences between new construction and ‘second-hand’ homes. New-build homes are not expected to be affected by the slight fall in house prices, although second-hand prices could fall between 3 and 7 per cent.

This is because demand for second-hand homes is expected to fall slightly due to rising mortgage rates and inflation, which means fewer people are looking to buy homes. This could reduce prices.

The Spanish property market is better insulated against expected price falls across Europe.

Is Spain different?

Why will the Spanish market not fully feel the expected price drops in the rest of Europe?

While it is true that the ECB has forecast a decline in property prices across the eurozone, conditions in the Spanish property market are relatively unique compared to those of its European neighbours – especially those in northern Europe.

Experts believe that the Spanish property market is more resilient to expected price declines across the continent, but that is not to say that property prices in Spain will not fall at some point in 2023, rather that they may not fall as much – 9 per cent as the ECB suggests – as in neighbouring eurozone countries.

José García Montalvo, professor of applied economics at Pompeu Fabra University in Barcelona, told Business Insider Spain that “what the ECB says does not apply to Spain. In other countries, prices are so high that the shock can be strong, but here [in Spanje] we have bottomed out.”

During the 2008 financial crisis and beyond, it was the southern European countries, led by Spain and Portugal, that were hardest hit by the bursting of the property bubble.

Consequently, the Spanish property market has never really recovered or experienced a “boom” like other northern European countries. While it is true that prices have risen in Spain, the property market has still not recovered and reached 2007 levels and pre-crisis prices.

Simply put, the Spanish property market is more resilient to the coming price falls expected across Europe in the next year or two precisely because it never recovered from the last property meltdown. The ECB’s estimated plunge of 9 per cent is therefore less likely in the Spanish market.

“It would be exceptional if we saw big drops while prices have not yet recovered from the previous crisis,” María Matos, spokeswoman for Fotocasa, told the Spanish press.

Marbella and other Andalusian cities benefit from new law

THE final regulations of a new rural construction law are about to be published.

They have been on the drawing board for a year, since the Junta de Andalucia approved the new LISTA law in December 2021.

But the precise regulations are needed to enable town halls to apply them.

The law will allow the construction of more housing in rural areas under strict criteria and conditions.

“It should be good news and yes, it will bring change,” explained countryside specialist Anita Schmidt of Villas and Fincas, based in Casares.

“We don’t want overbuilding in the country, but it will mean that many Hispanic families will finally be able to do something with their grandparents’ land, and it will be better maintained, so less risk of fire.

“It will also bring life back to some forgotten villages suffering from depopulation.

“And of course, foreigners with patience and perseverance may be able to find the right plot to build their dream home again.”

But she added that nothing is settled yet and she would not be surprised if it takes another year for local town halls to figure out how to deal with these new rules.

The new law means that PGOM city plans of several coastal towns and inland cities can finally be completed.

Marbella could be one of the first to benefit, as Mayor Angeles Munoz met with Junta officials in Seville last week to endorse a plan approved in the resort in September.

Among the planned changes is an increase in the area that can be developed from 40 million square metres to 52.2 million.