3 Reasons why Belgians and Dutch are investing in Spanish property in 2022

Estimated reading time: 11 minutes

Owning a property in Spain can be financially and emotionally rewarding. But making the right choice is, of course, decisive here. First, you need to make the right choice in terms of location, type of home and amenities. Furthermore, it is required to obtain reliable legal advice. In this article from staging.investinspain.be an overview with the most important facts, tips and reasons why many Belgians and Dutch people invest in Spanish real estate.

Table of contents

- Crisis and Spain: How resistant is the housing market?

- Luxury real estate Spain: Where do people with +1 million euro budgets invest?

- Why are many people investing in real estate in (southern) Spain these days?

- Why is the Costa del Sol so interesting for investors?

- 6 top tips to invest in property in Spain

- Free download: New construction investment checklist 2021

Crisis and Spain: How resistant is the housing market?

Spain has suffered badly from the global financial crisis and the resulting crash of the real estate market. House prices fell as much as 30%, but in the last few years the market has become more stable.

Since 2016, prices in Spain have risen steadily, and although the COVID-19 outbreak hit the market in 2020, official figures show that average prices rose in the second quarter of the year. Sales prices rose 2.1% year-on-year, with new construction prices up 4.2% and used homes up 1.8%.

Luxury real estate Spain: Where do people with +1 million euro budgets invest?

People from abroad with a budget of 1 million euros or more looking online for property in Spain are most interested in the Balearic Islands, followed by the Costa del Sol and Madrid, reveals a report by Idealista, one of Spain’s largest real estate portal.

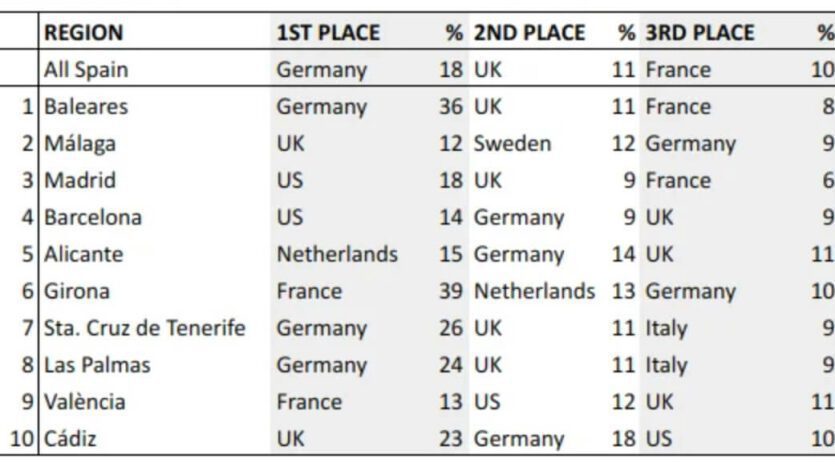

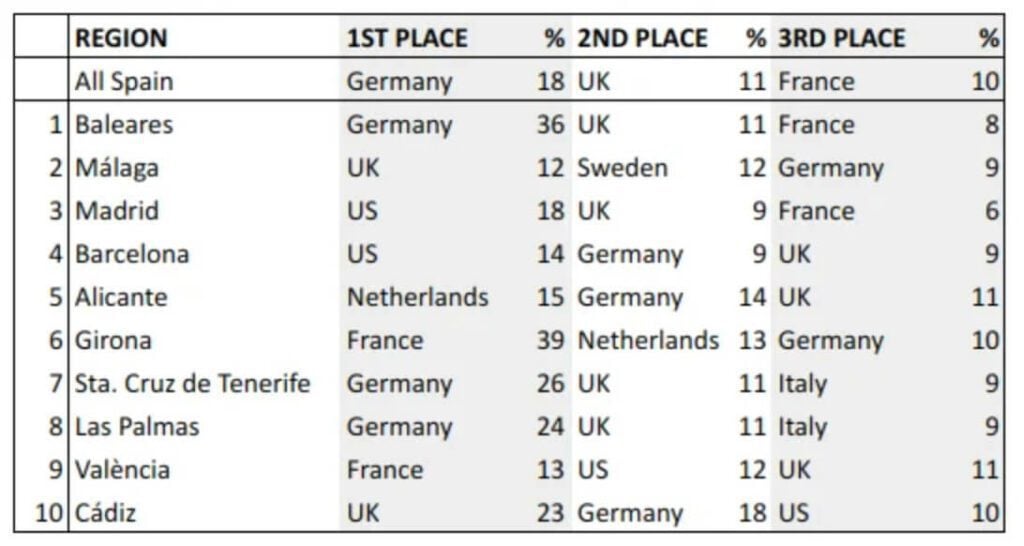

Idealista analyzed searches of its real estate sales database conducted by people outside Spain looking for a home with a budget of 1 million euros or more and found that 18% of searches were conducted from Germany, followed by 11% in the United Kingdom, and 10% in France.

The Balearic Islands was the most popular destination with 29% of all searches, of which 36% were conducted from Germany, 11% from the United Kingdom, 8% from France, 8% from the Netherlands, and 5% from Sweden.

Malaga province, home to the Costa del Sol , was next, with 16% of all high-end searches from abroad, led by the British and Sweden with 12% respectively, Germany 3rd with 9%, then the Netherlands 8% and the US with 7%.

Madrid drew 15% of searches with most from the U.S. at 18%, followed by the U.K. 9%, France 6%, Mexico 5%, and Portugal 5%. The large Latin American community in the U.S. could explain the strong interest in Madrid and other Spanish cities.

Barcelona received 11% of all high-end searches from abroad, with the US in first place with 14%, followed by Germany, the UK and France with 9%, and the Netherlands with 5%.

Alicante province, home to the Costa Blanca, and traditionally a British stronghold, attracted 8% of big-budget searches led by the Netherlands with 15%, followed by Germany 14%, the United Kingdom 11%, France 10%, and Sweden 6%. If you look at searches under 1 million euros you might find the UK in first place, but Brexit also reduces UK demand.

93% of all searches from abroad with a budget of 1 million euros or more focused on just 10 of Spain’s 50 provinces. Also in the top ten were the province of Girona, home to the Costa Brava, with 4%, the Canary Islands with 3%, and Valencia with 2%.

If you want to buy high-quality real estate in Spain, the Balearic Islands and the Costa del Sol are the places to be.

Why are many people investing in real estate in (southern) Spain these days?

- Transfer tax reduced in Costa del Sol (2021 only). See all the info here: https://investinspain.be/nieuwbouw-kopen-costa-del-sol-tips/overdrachtsbelasting-verlaagd-andalusie/

- Transfer tax Netherlands increased for investors. The transfer tax on homes was raised from 2% percent to 8% in 2021. So are you an investor and planning to invest in a property? Then, starting in 2021, you will pay 8% transfer tax on a home, compared to 2% previously.

Why is the Costa del Sol so interesting for investors?

Simply put…because of the stable real estate market on the Costa del Sol. And especially the Marbella and Estepona markets.

Since international celebrities first discovered the Costa del Sol in the 1960s, this part of Spain has always been about luxury living.

Not for nothing do Benahavis, Marbella and Estepona form the Golden Triangle, home to some of southern Europe’s most exclusive properties, most of which have a seven-figure price tag. Sotogrande joins them, another magnet for beautiful homes.

The top end of the market may have suffered from the 2006 economic crash, but it is proving to be a very resilient sector when it comes to pandemics. Despite Covid-19 (or perhaps because of it), the luxury housing market is currently booming on the Costa del Sol.

The reasons for the surge in activity, especially this year, are many. But as we shall see, they all share a common factor: lifestyle. And in the so-called California of Europe, this comes as no surprise.

More from our Costa del Sol real estate blog:

Reason 1 – working more remotely and in the sun

Almost overnight, millions of people started working from home instead of the office. This fundamental change in lifestyle brought about a shift in real estate trends. Suddenly, a home office became uber desirable.

Add to this the year-round sunshine on the Costa del Sol and it is easy to see why the world’s wealthiest want to work from home in luxury on the Costa del Sol. Especially when working remotely in Marbella or Sotogrande is perfectly combined with easy connections to the business centers of the world.

Reason 2 – extensive choice of luxury homes

As soon as you enter the municipality of Marbella from the east, there is a distinct rise in the feel of the property. You step into a world of beautiful homes that stretches all the way to Sotogrande in the west.

Many have multi-million dollar price tags and the majority offer cutting-edge design, quality, finish and features. In locations such as La Zagaleta, Sotogrande, the New Golden Mile in Estepona and Sierra Blanca in Marbella, high-net-worth individuals (HNWI) are literally spoiled for choice.

And much of what is on the market is new. Some of the world’s richest REITs(real estate investment trusts) have turned their attention this year to developing luxury homes on the Costa del Sol. A clear sign that the demand is there.

Moreover, the demand for these homes has shifted. Once the haven of wealthy retirees, the Costa del Sol is now a hot spot for affluent millennials. As younger HNWIs (high-net worth individuals) have turned their attention to the area, they have discovered that places like Marbella and Sotogrande are perfect for raising a family because they offer world-class international schools, private hospitals and the outdoors at its best.

Reason 3 Costa del Sol = (almost) always a safe investment

Our final reason why the Costa del Sol luxury housing sector is booming lies in the nature of the property. Real estate is the backbone of all successful investment portfolios for two main reasons:

- The underlying trend in real estate prices is always up, regardless of lows and highs in any given cycle.

- Real estate is literally as safe as houses.

Taking this as a starting point, REITs have focused their attention on the Costa del Sol for the past 18 months. And as a result, the area has become a hotspot for foreign investment funds.

The American REIT, Värde Partners, for example, now has 20% of its funds on the Costa del Sol, its second-largest market. Earlier this year, France’s Firce Capital invested in the project La Fuente in Marbella as part of its new “premium” fund. And Germany’s Deutsche FI has invested in three high-end residential developments on the Costa del Sol since September 2020.

6 top tips to invest in property in Spain

six important things you need to know to get it right and make more profit:

- Weigh the pros and cons: should you buy to rent or buy to sell? Buying a property to rent out has the advantage of having a fixed monthly income and a property in progressive revaluation. The benefits include higher income than traditional rentals, guaranteed payment up front and greater availability of the property for your own enjoyment. On the other hand, buying a home to resell later is less financially risky if it sells for a higher price than you bought it for, and can net you a nice, hefty lump sum.

- Choose your property based on the investment objective: the type of property you buy will change according to the investment option. Furnished properties with one or two bedrooms are ideal for short-term rentals, such as vacation rentals and properties targeting a more executive audience and with labor mobility. With a view to rental or long-term sale, the most suitable housing option you can buy is a well-distributed, outdoor 2 or 3 bedroom apartment with an elevator and parking space.

- Go for big cities and tourist enclaves: if you prefer to buy with the intention of selling, it is best to choose Spanish cities such as Madrid and Barcelona where the market is more dynamic. It is also advisable to buy in provincial capitals such as Santa Cruz de Tenerife, Palma de Mallorca, Valencia, Malaga, Alicante, Pamplona, Gipuzkoa or Murcia, areas that are seeing more revaluation of house prices. Location is also important when investing to rent. Madrid, Barcelona and San Sebastian are the most expensive cities. The most touristic regions, such as the Costa del Sol, are also an excellent option worth considering for both types of investments. The reason is the growing demand for second homes in beach areas and the proliferation of vacation rentals.

- Prefer established areas: the best place to look for housing is in already consolidated neighborhoods with affordable prices, high demand for rental housing, good transportation links and nearby services. In Madrid, for example, neighborhoods adjacent to the M30 ring road are proving to be an interesting choice. It is also a good idea to invest in major business centers and university areas, as they will always be in demand. Of course, the best option is to buy a downtown property, but the initial investment will always be much higher.

- Good condition of the property : in the case of rentals, it is important to keep in mind that your property must be in good condition to attract tenants. If you want to renovate the home after purchase, make sure the purchase price is low enough and that the home has no complicating factors. This is the only way to make remodeling more affordable. The average cost of a complete home renovation can be around 450-500 euros/m2.

- How to calculate profitability: to estimate the initial investment, you need to consider more than just the initial purchase price. You should also add taxes, the cost of operation and expenses for refurbishing the house (painting, electrical appliances, furniture, etc.). Only when you take all these costs into account can you calculate the profitability of your potential investment in property in Spain.

Free download: New construction investment checklist 2021

More real estate pages from InvestinSpain.be

- Marbella Apartment for Sale

- Marbella apartment

- Apartment for sale Estepona

- Buying a house in marbella spain

- Apartment for sale Spain Costa del Sol

- Villa for sale Spain by the sea

- Apartment for sale Spain by the sea

- Property in Spain Marbella

- Investing in real estate in Spain

- New construction Spain Costa del Sol

- Luxury vacation homes Marbella